OP/ED: Our Educational System’s Influence On Student Loans

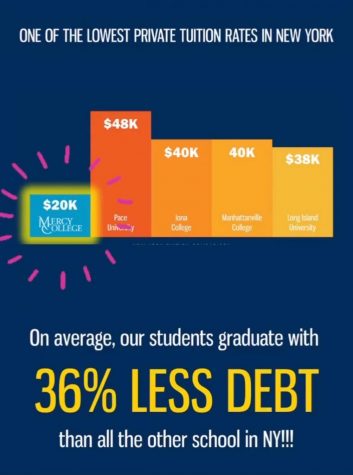

This image was shared on Mercy College’s Instagram account, and it seems like a positive image of the college. Indeed, Mercy is the best financial option for a private school in New York. However, take a look at the bigger picture or focus on the words 36 percent Less Debt. The word “debt” especially, is used as a regular word as if it is normal for students to graduate with debt.

This image was shared on Mercy College’s Instagram account, and it seems like a positive image of the college. Indeed, Mercy is the best financial option for a private school in New York. However, take a look at the bigger picture or focus on the words 36 percent Less Debt. The word “debt” especially, is used as a regular word as if it is normal for students to graduate with debt.

Unfortunately, debt has been normalized.

According to educationdata.org, the total student loan debt in the United States adds up to $1.71 trillion, and it increases six times faster than the nation’s economy. The data states that 43.2 million students with loans have a debt average of $39,351 each. With the impact of COVID-19 and unemployment, the nation has seen the largest increase in student loans. A total of 3.2 million new federal student loans have been reported since the start of the pandemic.

At the beginning of the spring semester, many students, including myself, had gone through hardships that prevented me from being able to afford to pay my tuition. With no option, I made a plea to the financial aid counselor. My heart was poured out in the email about all the financial struggles I was going through and I asked for resources and additional financial help.

The response that I received is copied directly from the financial aid counselor’s email to me.

“Are you willing to take some funds out in loans? You do not need the full amount offered, but just a portion of what is being offered. It will clear the balance on the account for the fall, then again for the spring. We could keep it within the subsidized loan which is the best one out of the two loans that are offered, as it is interest free while you are in school.”

I was already going through a hard time, so this message left me utterly disappointed. The last piece of advice that a student wants is to get into additional debt and more financial and emotional distress. I went on to express my feelings towards student loans and told her I did not have the credit standards or a viable co-signer to take out loans.

Her response was: “With regard to the loans-you were offered loans that aren’t based on credit. We could use some of those to clear the balance for now. That way you are clear and no issues with our side.”

No additional resources were provided, which is usually the case for most students at most college institutions. Student debt keeps increasing by the minute, and colleges are not providing students the necessary knowledge and guidance before shoving student loans down their throats. The educational system is completely flawed.

“My school has never offered me money beyond the emergency COVID-19 fund I had to beg for. No scholarships, no student aids, nothing. They said if the situation was bad enough, to pay $400 and apply to possibly get a chance at getting economic hardship working papers,” said Kadiatou Diarra, a marketing student a Baruch College.

Diarra is an international student, and her odds of receiving college assistance are even lower than regular students.

“They guide you towards high-interest loans—you can’t apply for federal loans since you have no social and you aren’t American or else I would’ve, believe me— just to pay off an immense amount of tuition, which costs have seemed to increase significantly since I first started ($6,000 something to $9,000 something a semester for a public university, even online). No help, no tax breaks, just privatized loans and depression.”

There needs to be a better solution after pushing American students into college then saddling them with debt at nearly 7 percent interest.

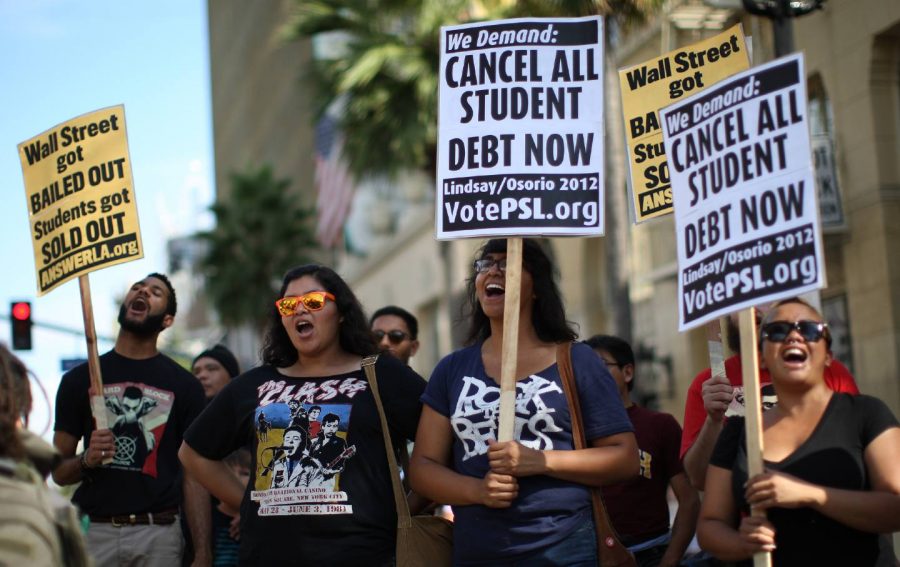

There has been increased pressure from Senator Elizabeth Warren, urging that President Joe Biden cancel student debt. Under the Coronavirus Aid, Relief, and Economic Security (CARES Act), more than 35 million borrowers qualify for student debt relief. Unfortunately, a bill that includes assistance for international students or any student with a private loan is yet to be approved.

Yet here we are. The choice of the American Dream. Get an education, chase and your dreams, and be juiced for seven percent while doing it. Politicians promise loan perform. I have heard this over and over in my lifetime. Yet the more things change the more they stay the same.

No one is asking for free college. Just affordable tuition with manageable interest.

Nicole Alarcon is a senior at Mercy College, majoring in journalism. Born in São Paulo, Brazil, she moved to the United States at 10-years-old.

Nicole...